Ajita Insights | A deconstruction of generational stewardship, the H51 defense, and why Hermès is a sovereign entity disguised as a luxury maison.

In the theater of global finance, Hermès is not a fashion company; it is a Legacy Institution. While most luxury brands have surrendered to the homogenization of massive conglomerates, Hermès stands as the final citadel of independence. Their secret lies not in the craftsmanship of leather, but in a Power Structure designed to withstand the erosion of time and the aggressive gravity of the market.

At The Ajita, we analyze the Hermès survival strategy as the ultimate masterclass in Institutional Integrity.

The Stealth Accumulation: The Corporate Siege

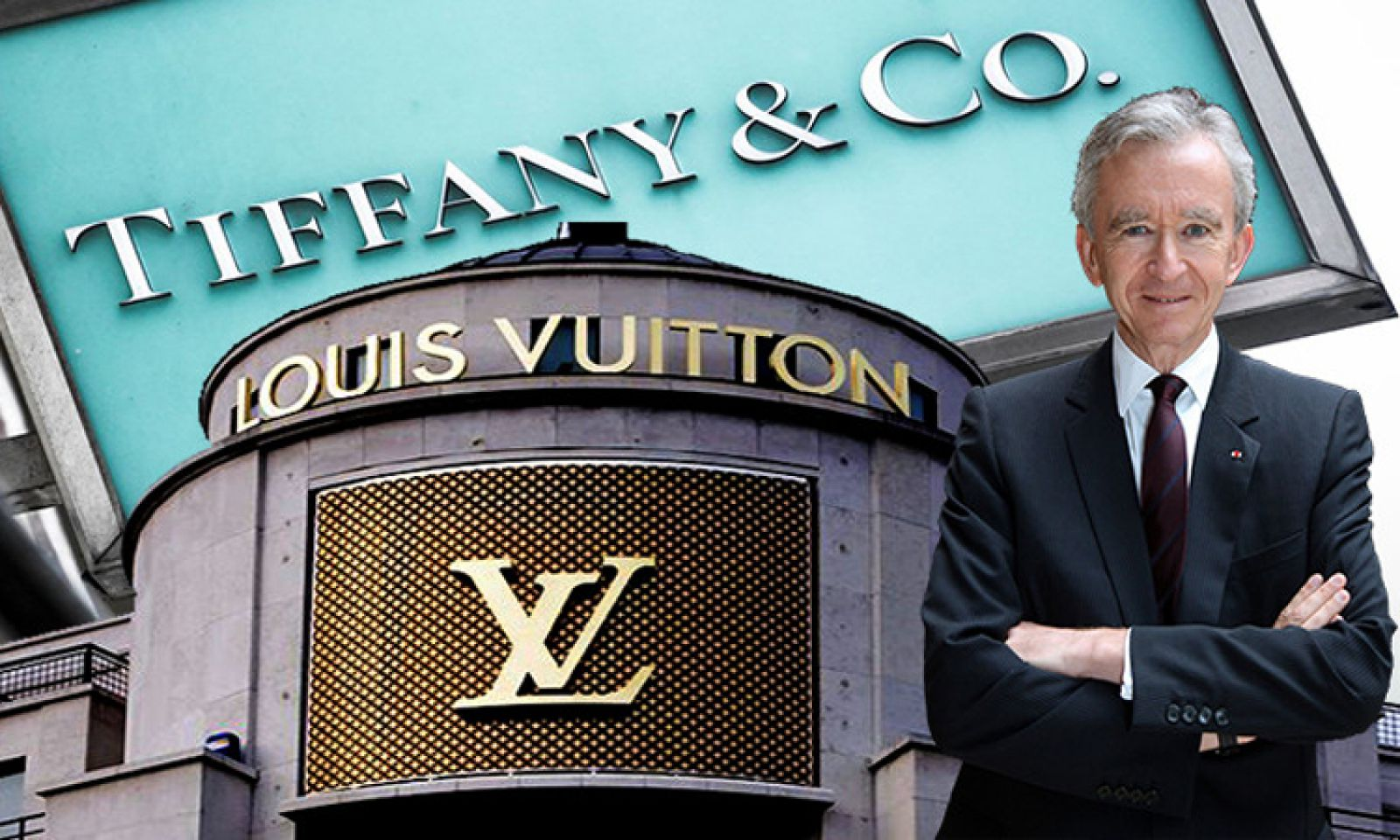

In 2010, the global luxury landscape was rocked when LVMH revealed it had quietly amassed a 17% stake in Hermès. Utilizing complex financial instruments known as "Equity Swaps," the outsider managed to bypass standard disclosure requirements, effectively mounting a "silent siege" on the family-owned maison.

For any other entity, this would have been a death sentence—the beginning of a forced assimilation. But the intruder made a critical strategic error: he underestimated the Biological Will of the family.

The H51 Gambit: Sacrificing Liquidity for Autonomy

To counter the threat, over 50 members of the Hermès family executed a move that redefined corporate defense. They created a holding company named H51, locking up 50.2% of their total shares for a minimum of 20 years.

- The Strategic Sacrifice: Family members voluntarily forfeited their ability to sell shares for cash (liquidity) for two decades.

- The Objective: To create an impenetrable "shield." By locking the voting rights, they ensured that no amount of external capital could ever seize control of the maison’s narrative.

This move exemplifies a core Ajita principle: Ethics is Risk Management. The Hermès family did not chase short-term profit; they prioritized long-term consistency to protect a century of ROI.

The Rejection of Visibility: Intimacy over Growth

Hermès remains the only global entity of its scale without a traditional marketing department. They do not pursue market share; they pursue Absolute Scarcity.

- They do not "select" customers; customers must prove their "worthiness" to gain access to the most coveted assets.

- By maintaining Strategic Friction in the purchasing process, they protect the asset value for those who already belong to the inner circle.

The Ajita Note: Sovereignty is the Ultimate Luxury

The distinction between the "Rich" and the "Elite" lies in the capacity to say No. Hermès said 'No' to the world’s most powerful conglomerate, 'No' to aggressive growth, and 'No' to the logic of the stock market.

The lesson for the modern strategist is clear: Sovereignty cannot be bought; it must be engineered through a shared Narrative. If you do not build a fortress around your legacy, external forces will always find the cracks. At Hermès, silk is not just a fabric; silk is the armor of a dynasty.

Strategic Takeaway: True independence is the ability to remain indifferent to the pressures of external capital. Sovereignty is the only asset that cannot be replicated.